Contents

Some people want to scalp or day trade, but losses chased them to be a swing traders or holder. A tool that investors and traders can use to filter ETFs based on user-defined metrics. ETF screeners are offered on many websites and trading platforms, and they allow users to select trading instruments that fit a certain profile set of criteria. To get your class started with our free stock market game, just register now and then follow the links to create your own contest.

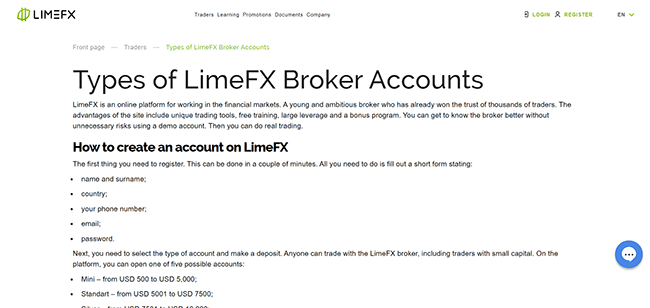

Trying to find the“mathegym”Portal and you want to access it then these are the list of the login portals with additional information about it. But beginner investors might want to get started with a beginner broker before stepping up to a hands-on platform like M1. Experienced investors will find a great home for their investments at M1 due to the amount of control they have over their portfolios. As you can see, M1 Finance is a spectacular investing platform, but that doesn’t mean that it’s right for everyone. The way M1 orchestrates your trading during designated trading windows means you can’t always buy or sell a stock at the exact second you want to do it.

- I have often been trapped in such a situation and did nothing just came out of the market.

- And if the market conditions are uncertain, I prefer not to trade for a while and will watch the market movement to find my way into the market.

- For purchases at companies not in those tiers, cardholders will earn 1.5% cash back everywhere else.

- But Most of the time you will definitely reach the correct login pages because we have verified all the links on Loginma.com without compromise.

Forex is derived from the words Foreign Exchange which is known as the global market that does business in money trading. This is a financial simulation, no real accounts are being opened, no jobs are being offered and nothing of monetary value is being exchanged or placed in any accounts. Register and immediately receive $100,000 in virtual cash and get access to all the helpful lessons and videos in our Education Center. All users can create their own custom contests and challenge their friends, family or co-workers. Kucoin has some years in the cryptocurrency market and they provide good service to their users. They belong to Tier 1 exchange list and their scores on Coinmarketcap, Coingecko are good too.

Popular Canadian Stocks

If I get trapped somefinancing your home businesss I use such escape and wait for the next right move or otherwise stay out till the next day as a day trader. Each type of trading has its own advantages and disadvantages, and traders should choose the type of trading that best suits their goals and strategies. I prefer to avoid risk by trading with the amount of money I can afford. And if the market conditions are uncertain, I prefer not to trade for a while and will watch the market movement to find my way into the market. But if the market situation reverses in the middle of my trading and I get stuck in that situation, I will hold on and not continue trading because it will not be good for me.

The M1 Spend Checking account deposits your money with Lincoln Savings Bank, M1 Finance’s partner bank. Unfortunately, free users do not receive interest on their balance or cash back on purchases. To be eligible to borrow money, your portfolio must be worth at least $2000. Then, I would add these two pies to my main portfolio and give them each a 50% weight, and boom!

The program checks the results and provides numerous aids, including explanatory videos. Stocktrak has a high Google pagerank and bad results in terms of Yandex topical citation index. We found that Stocktrak.com is poorly ‘socialized’ in respect to any social network. According to MyWot, Siteadvisor and Google safe browsing analytics, Stocktrak.com is a fully trustworthy domain with mostly positive visitor reviews.

According to Siteadvisor and Google safe browsing analytics, Quivervision.com is quite a safe domain with mostly positive visitor reviews. Mathegymis a multi-award-winning math learning platform designed by teachers for grammar school and secondary school. It provides tasks of varying degrees of difficulty on almost all topics in grades 5-13 that can be solved online.

While M1 does offer Expert Pies that are already created for you, you won’t get any tips on how to balance your portfolio’s asset allocation or tools to help you plan for retirement. For purchases at companies not in those tiers, cardholders will earn 1.5% cash back everywhere else. M1 Plus members will also receive interest at a 3.30% APY for the money deposited in their Spend Checking account and 1% cash back on purchases. You can set up direct deposit and automatic transfers, and you even get instant transfers between your M1 accounts so you can have quicker access to your money.

If you are already logged in to an account, clicking any of the stock market contest “join” buttons will automatically enter you into the contest – just switch to your contest portfolio and start trading. So the term day trading, weekly or long-term trading appears. You should not insist on overwhelming everyone because it will only make your trading not optimal. So I trade on the basis of a sense of comfort and with the risks that are always there.

How do I know I can trust these reviews about HowTheMarketWorks?

Trading fee is on percentage, and on the exchanges that I have used, it is around 0.01% to 0.05%. As a caring company,Burlingtoncontinues to be committed to the communities where we live and work. Quivervision has the lowest Google pagerank and bad results in terms of Yandex topical citation index. We found that Quivervision.com is moderately ‘socialized’ in respect to Facebook shares (6.03K), Twitter mentions and Google+ shares .

HowTheMarketWorks.com® is a property of Stock-Trak, Inc., the leading provider of educational budgeting and stock market simulations for the K12, university, and corporate education markets. All information is provided on an “as-is” basis for informational purposes only, and is not intended for actual trading purposes or market advice. Quote data is delayed at least 15 minutes and is provided by XIGNITE and QuoteMedia. Neither Stock-Trak nor any of its independent data providers are liable for incomplete information, delays, or any actions taken in reliance on information contained herein. By accessing the How The Market Works site, you agree not to redistribute the information found within and you agree to the Privacy Policy and Terms & Conditions.

As long as you don’t need to be able to make trades at a moment’s notice, you’ll be good to go with M1. There are no commissions on trades and no monthly fees on M1 Spend Checking. M1’s partner banks are FDIC insured, so you won’t have to worry about the money in your M1 Spend Checking account being lost, either. M1 Finance has been in business since 2015 and has over half a million users who have invested more than $4.5 billion on their platform. There is a 2.5% cash back tier, a 5% cash back tier, and a 10% cash back tier.

It is long-https://business-oppurtunities.com/ fun and depending on your competition, can be rewarding. All trading uses real-time bid/ask prices, giving your students the same experience as Wall Street traders. Best of all, the Class Rankings update constantly throughout the day – adding an element of competition to keep your students engaged all semester long.

An annual list put together by FORTUNE Magazine of the 500 largest companies. This list uses the most recent figures for revenue and includes both public and private companies with publicly available revenue. All the other influences like debt, balance sheets, earnings and so on affect the desirability of owning a stock. Every contest has a starting portfolio value of $100,000 USD, allows only US equities and ETFs. We have different version of our platform depending on what type of contest you want to run.

Benzinga Pro Review: Is it Worth It?

The platform uses a unique portfolio construction system centered around “pies” that gives you total control of how your portfolio looks while also emphasizing automated investing. A comprehensive analysis of amaxuniversity.com by ServiceHostNet. Claim your listing for free to respond to reviews, update your profile and manage your listing.

Some are more suitable for short-term traders, while others are more suitable for long-term traders, and there are trading types that emphasize technical or fundamental analysis, as well as those that rely on risk and capital management. You should not insist on overwhelming all because it will only make your trading not optimal. We can’t avoid any risk, maybe if you don’t want to get the risk of trading stop trading. If you are trading then you must be disciplined, technical and fundamental.

Tried to be a day trader before, at first its easy since Im still motivated to make money in the market and honestly Day trader for me are more about guessing the trend than to analyze it, so the result for me was not good. After losing some of my capital in day trading, I decided to try to do a short term trade which I started to analyze, set-up my target price and my cut loss price so far Im doing good with this. Day trading is very risky, it requires a lot of attentions and time, so dont be a day trader if you will not spend time to analyze because it will just consume all your capital, this is not worth it if you will just guess your trades.

Stocks represents a claim on the company’s assets and earnings. As you increase your holdings of a stock, your ownership stake in the company increases. Whether you say shares, equity, or stock, it all means the same thing. Common and preferred are the two main forms of stock; however, it’s also possible for companies to customize different classes of stock in any way they want. Stock market prices are affected by business fundamentals, company and world events, human psychology, and much more.

Burlington Coat Factory in Saginaw, MI 48604 – Hours Guide

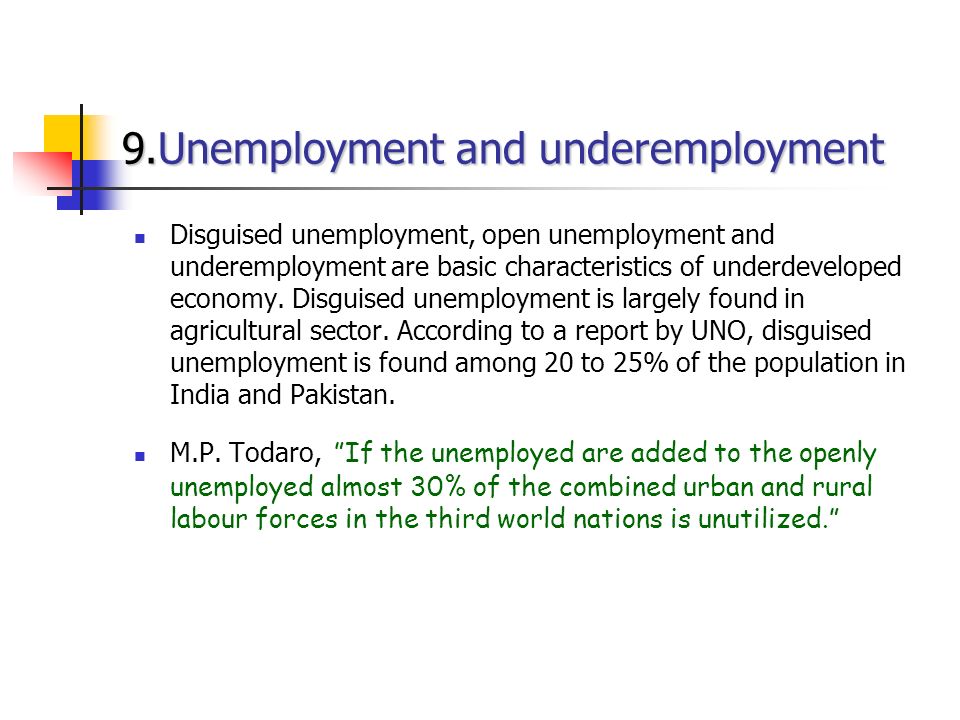

Day trading is the act of buying and selling cryptocurrencies within a single day in order to make short-term profits. As a matter of fact, day traders are akin to tightrope walkers. These individuals must be able to deal with high trading costs, a volatile market, regulatory risks, and other unpredictability. In spite of these, I see that there are a lot of people who still want to go into day trading.